Business

FintechZoom.com lifestyle: Smart Money Habits for Modern Life

Introduction to FintechZoom.com lifestyle

Welcome to the world of FintechZoom.com lifestyle, where savvy money management meets modern living. In today’s fast-paced environment, mastering your finances is more important than ever. With countless apps and tools at our fingertips, managing money has transformed from a daunting task into an achievable goal. This blog post dives into smart money habits that fit seamlessly into contemporary life. Whether you’re saving for a dream vacation or simply trying to make ends meet, embracing these strategies can set you on a path toward financial freedom and peace of mind. Let’s explore how you can enhance your financial well-being with practical tips tailored for today’s busy lifestyles!

Importance of Smart Money Habits in Modern Life

In today’s fast-paced world, smart money habits have become essential. With countless financial options available, making informed decisions is crucial.

Understanding where your money goes can help you avoid unnecessary debt. Budgeting empowers individuals to prioritize their spending on essentials rather than whims.

Moreover, developing good financial practices fosters a sense of security. It allows individuals to prepare for unexpected expenses and emergencies without stress.

Smart money management also paves the way for future goals. Whether it’s buying a home or saving for retirement, every dollar saved today contributes to tomorrow’s dreams.

In an era dominated by technology and instant gratification, practicing sound financial habits ensures long-term stability. Embracing these principles leads not only to better finances but enhances overall well-being in daily life too.

Tracking Your Expenses and Budgeting

Tracking your expenses is a crucial step in mastering your finances. It allows you to see where every dollar goes, shedding light on spending habits that may surprise you.

Start by keeping a detailed record of all purchases. Use apps or spreadsheets—whatever feels comfortable for you. The goal isn’t just to track but also to understand.

Budgeting complements this tracking process beautifully. Set realistic limits based on historical data from your expense records. Allocate funds for essentials first, then consider savings and discretionary spending.

Regularly review and adjust your budget as necessary. Life moves forward, and so must your financial planning.

This practice cultivates awareness around money management, empowering you to make informed choices tailored to the fintechzoom.com lifestyle you’re aiming for. Small shifts can lead to significant change over time, making budgeting not just an exercise but a vital tool in building wealth.

Using Technology to Manage Finances with FintechZoom.com lifestyle

In today’s fast-paced world, technology is your best ally for managing finances. The fintechzoom.com lifestyle embraces innovative tools that simplify money management.

Mobile apps are game-changers. They allow you to track spending in real-time, categorize expenses, and identify saving opportunities at a glance. Imagine a money-management guide accessible anytime, anywhere.

Online banking platforms also offer seamless integration with budgeting tools. You can set financial goals and get alerts when you’re nearing limits or need to adjust your budget.

Moreover, digital wallets streamline payments while keeping security tight. Instead of fumbling for cash or cards, you can pay effortlessly using just your smartphone.

With automated savings features available on many apps, saving becomes less daunting. Set it and forget it – let technology do the hard work for you while you focus on enjoying life without financial stress.

Tips for Cutting Expenses and Saving Money

Cutting expenses starts with a clear assessment of your spending habits. Take a moment to jot down where your money goes each month. This can reveal unnecessary subscriptions or impulse purchases.

Embrace the power of discounts and compare prices before making any purchase. Apps can help you find better deals, ensuring you never pay full price again.

Consider meal planning as a way to reduce grocery costs. Preparing meals at home not only saves cash but also promotes healthier eating choices.

Don’t forget about energy efficiency in your home. Simple changes like turning off lights when leaving a room can lead to significant savings on utility bills over time.

Set specific savings goals that motivate you. Whether it’s for travel, an emergency fund, or retirement, having tangible targets makes saving feel more rewarding and achievable.

Planning for Retirement and Unexpected Expenses

Planning for retirement is crucial. It’s about ensuring a comfortable lifestyle when the daily grind fades away. Start early, even if it’s just a small amount each month.

Unexpected expenses can derail your plans. Think car repairs, medical bills, or home maintenance costs. Having an emergency fund helps cushion those blows.

Consider setting aside three to six months’ worth of living expenses in this fund. It offers peace of mind and keeps you from dipping into retirement savings during emergencies.

Use budgeting tools available on fintechzoom.com lifestyle to track both regular expenses and potential surprises. Staying organized makes financial planning much smoother.

Remember that flexibility is key as you plan ahead. Life changes; so should your strategies for managing money and preparing for the future.

Balancing Lifestyle and Financial Goals

Finding the right balance between lifestyle choices and financial goals is essential. Modern life often tempts us with instant gratification, making it easy to overlook long-term objectives.

Start by identifying what matters most to you. Are travel adventures your passion? Or perhaps investing in education or experiences holds more value?

Set realistic budgets that allow for both enjoyment and savings. Allocate a portion of your income for leisure activities while ensuring you’re also contributing to your future.

Consider using tools offered by fintechzoom.com lifestyle to track spending habits effortlessly. This can help pinpoint areas where adjustments can be made without sacrificing quality of life.

Remember, it’s about moderation. Indulging occasionally in small luxuries can prevent feelings of deprivation, which often lead to overspending later on. Balancing these aspects will empower you towards achieving financial stability while enjoying life’s pleasures too.

Conclusion: Taking Control of Your Finances with FintechZoom.com lifestyle

Taking control of your finances can seem daunting, but with the right approach and tools, it becomes manageable. Embracing the fintechzoom.com lifestyle empowers you to make smart financial decisions that align with your daily life.

By implementing effective tracking systems for expenses and budgeting, you pave a clearer path toward financial security. Technology plays a vital role here; leveraging innovative apps and online resources helps simplify complex tasks.

Cutting unnecessary expenses is another key strategy for building savings while still enjoying life’s pleasures. Prioritizing retirement planning ensures you’re prepared for future uncertainties without compromising your current lifestyle.

Striking a balance between what you want now and what you’ll need later is essential in today’s fast-paced world. With every informed choice, you’re not just managing money—you’re crafting a fulfilling life.

The journey towards financial empowerment begins today, inviting you to explore how adopting these smart habits through the fintechzoom.com lifestyle can lead to greater peace of mind and freedom in your everyday choices.

Business

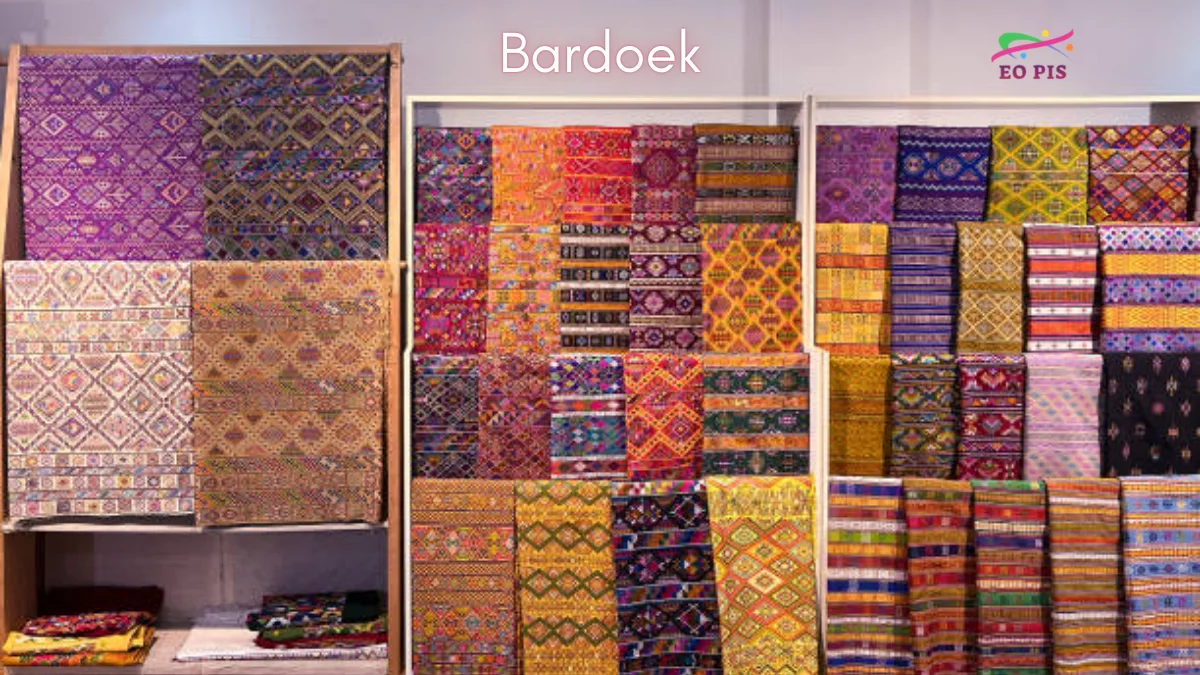

Bardoek: Vibrant Handcrafted Textiles with Cultural Heritage

Introduction to Bardoek

Bardoek textiles are more than just fabric; they are vibrant expressions of culture, tradition, and artistry. Each piece tells a story woven into its very threads—stories that connect generations and celebrate heritage. As we delve deeper into the world of Bardoek, you’ll discover how these handcrafted textiles embody not only exquisite craftsmanship but also the spirit of communities dedicated to preserving their cultural identity. If you’re looking for unique pieces that carry history along with style, Bardoek offers a treasure trove worth exploring. Let’s embark on this colorful journey together!

The History and Cultural Significance of Bardoek Textiles

Bardoek textiles carry stories woven into their very fabric. Originating from a rich cultural tapestry, these handcrafted pieces reflect the heritage of communities that have thrived for generations.

Historically, bardoek served not just as clothing but as symbols of identity. Each pattern and color choice represents local traditions and beliefs. The artistry involved is often passed down through families, making every piece unique.

These textiles played essential roles in various ceremonies and daily life. They were used to mark significant events like weddings or festivals. Through time, bardoek has become synonymous with cultural pride.

As globalization expands, the importance of preserving these traditional practices becomes even more apparent. Bardoek textiles stand as a testament to resilience amidst modernization while celebrating deep-rooted customs that continue to inspire today’s artisans.

The Traditional Process of Creating Bardoek Textiles

The traditional process of creating Bardoek textiles is a fascinating blend of artistry and craftsmanship. Each piece begins with the careful selection of high-quality natural fibers, often sourced locally. Artisans understand that these materials are essential to the final product’s texture and durability.

Dyeing follows, where vibrant colors come from organic sources such as plants and minerals. This step not only imparts beauty but also connects the textiles to their cultural roots.

Next comes weaving, a skill passed down through generations. Using handlooms, artisans intricately weave patterns that tell stories or represent significant symbols within their culture.

Finishing touches are applied, ensuring each item meets high standards before it reaches consumers. This meticulous process reflects dedication and respect for tradition while celebrating creativity in every stitch made by talented hands.

Modern Adaptations and Uses of Bardoek Textiles

Bardoek textiles are no longer confined to traditional roles. Today, they find new life in contemporary fashion and home decor. Designers embrace the vibrant colors and intricate patterns, integrating them into modern garments that celebrate cultural heritage.

These textiles can be seen transforming everyday items like cushions, table runners, and wall art. Their unique aesthetic adds a touch of authenticity to any space.

Sustainable fashion enthusiasts also gravitate towards bardoek for its eco-friendly production methods. Wearing these pieces not only showcases style but also tells a story rooted in history.

Craft markets and online platforms showcase innovative uses as well—think bags that blend functionality with flair or accessories that make bold statements. Bardoek is evolving while still honoring its rich traditions, proving versatile enough for today’s discerning consumers seeking both beauty and meaning.

The Global Impact and Recognition of Bardoek Textiles

Bardoek textiles have gained international acclaim for their vibrant colors and intricate patterns. Artists and designers around the world are now showcasing these handcrafted pieces in various exhibitions, highlighting their unique charm.

Their cultural significance resonates with those who value authenticity. Bardoek’s artistry embodies centuries of tradition, making it a sought-after symbol of heritage.

Fashion brands increasingly incorporate Bardoek designs into their collections. This fusion creates a bridge between ancient craftsmanship and contemporary style.

Social media has further amplified this recognition. Beautiful images of Bardoek textiles flood platforms, inspiring enthusiasts to seek out genuine pieces.

As more people discover the beauty of Bardoek, demand rises. This growing interest not only celebrates the art form but also elevates its makers on a global stage.

Supporting Local Communities Through Bardoek Textile Production

Bardoek textiles represent more than just vibrant colors and intricate designs; they are lifelines for local communities. Each piece is a reflection of the artisan’s heritage, skill, and dedication. By choosing Bardoek, consumers directly contribute to sustaining these traditional crafts.

Artisans often work in cooperative groups that empower them economically. This collaboration fosters a sense of unity and shared purpose among creators. As demand for authentic Bardoek rises, so do opportunities for local families to thrive.

Moreover, these textile projects preserve age-old techniques passed down through generations. When you support Bardoek production, you help maintain cultural narratives that might otherwise fade away.

Investing in these handcrafted pieces means investing in people—ensuring fair wages and improving living conditions within their communities. It’s not merely about purchasing a product; it’s about being part of an enriching story woven into every thread.

Where to Find and Purchase Authentic Bardoek Textiles?

For those eager to embrace the vibrant world of bardoek textiles, finding authentic pieces is part of the adventure. Local markets in regions known for their craftsmanship are prime spots to explore. Here, artisans often showcase their work directly.

Online platforms have also become treasure troves for enthusiasts. Websites dedicated to ethical fashion and handmade goods frequently feature bardoeks items, allowing you to shop from anywhere in the world.

Visiting cultural festivals or textile fairs can lead you to reputable vendors who prioritize quality and heritage. These events celebrate traditional art forms while connecting buyers with makers.

Social media has transformed how we discover unique craftspeople. Follow hashtags related to bardoek textiles or artisan communities; you’ll find endless inspiration and options right at your fingertips!

Conclusion: Preserving Cultural Heritage through Bardoek?

Bardoek textiles are more than just vibrant pieces of fabric; they embody a rich tapestry of cultural heritage and history. Each piece tells a story, showcasing the artistry and tradition passed down through generations. By embracing these unique textiles, we not only celebrate their beauty but also contribute to the preservation of an important cultural identity.

Supporting local artisans ensures that this age-old craft continues to thrive in today’s fast-paced world. As consumers, we have the power to make conscientious choices about what we purchase and support. By choosing authentic Bardoek textiles, you become part of a movement that values craftsmanship and cultural narratives over mass production.

The journey of Bardoek from traditional roots to modern adaptations is an inspiring tale that deserves recognition. These handcrafted items bridge gaps between cultures while allowing us to appreciate diverse traditions in our everyday lives. Investing in Bardoeks means investing in stories worth sharing—a reminder that behind every textile lies a community dedicated to preserving its legacy for future generations.

As awareness grows around sustainable practices and ethical consumption, Bardoeks stands as a testament to how art can influence positive change within communities worldwide. Each time you wrap yourself in or decorate your space with beautiful Bardoeks textiles, you’re not just owning something exquisite; you’re also honoring the culture it represents and supporting those who create it thoughtfully and lovingly.

Business

AgTalk: Connecting Farmers with Insights, Innovation, and Growth

Introduction to AgTalk

In a world where agriculture is evolving at lightning speed, farmers face unique challenges and opportunities every day. Enter AgTalk, a dynamic platform designed to bridge the gap among those in the farming community. Imagine a space where ideas flourish, innovations blossom, and connections spark growth. This isn’t just another online forum; it’s a powerhouse of knowledge that equips farmers with the tools they need to thrive in an ever-changing landscape. Whether you’re looking for expert advice or cutting-edge technology updates, AgTalk has something for everyone involved in agriculture. Let’s dive into how this platform transforms farming through connection and collaboration.

The Importance of Connecting Farmers

Connecting farmers is crucial in today’s agricultural landscape. As the world faces challenges like climate change and fluctuating markets, collaboration becomes a lifeline.

Farmers often work in isolation, but sharing experiences can lead to innovative solutions. By connecting with one another, they can exchange valuable insights that enhance productivity and sustainability.

Networking fosters community support. When farmers unite, they create a robust network where knowledge flows freely. This camaraderie promotes resilience against common threats such as pests or unpredictable weather patterns.

Moreover, connections open doors to opportunities for partnerships and resource sharing. Farmers who collaborate can access better tools and technologies that may have been out of reach individually.

Building these relationships strengthens the entire agricultural sector. It cultivates an environment of trust where everyone benefits from collective growth and innovation.

How AgTalk Works?

AgTalk operates as a dynamic platform designed specifically for farmers. Users can create profiles and share their farming experiences, challenges, and solutions with peers.

The interface is user-friendly, allowing easy navigation across various topics. Whether one seeks advice on crop management or the latest in sustainable practices, information is readily accessible.

Members engage in discussions through forums and chat features. This fosters real-time conversations that nurture collaboration among users from diverse backgrounds.

Additionally, AgTalk curates expert content tailored to user needs. Articles, videos, and webinars cover innovations in agriculture while promoting best practices.

By facilitating knowledge transfer between experienced farmers and newcomers alike, AgTalk cultivates an environment where learning thrives. It empowers users to stay informed about industry trends while encouraging proactive problem-solving within the community.

Insights: Expert Advice and Knowledge Sharing?

AgTalk serves as a hub for expert advice that empowers farmers to make informed decisions. Knowledge sharing is at the core of its mission, bringing together seasoned professionals and new entrants in agriculture.

Farmers can tap into a wealth of information from agronomists, market analysts, and experienced peers. This collective wisdom helps tackle challenges ranging from pest management to crop selection.

Interactive forums allow users to ask questions and share their own experiences. It creates an environment where learning becomes a shared journey.

The insights are not just theoretical; they’re grounded in real-world applications. Users can implement strategies tailored to their unique farming situations, enhancing productivity and sustainability.

By fostering open dialogue, AgTalk transforms how agricultural knowledge circulates. Every interaction leads to deeper understanding and practical solutions that benefit everyone involved in the farming community.

Innovation: New Technologies and Tools for Farming

Innovation is transforming the farming landscape rapidly. Farmers now have access to cutting-edge technologies that enhance productivity and sustainability.

Precision agriculture tools are leading the charge. Drones equipped with cameras provide aerial views of crops, helping farmers monitor health and identify issues early on.

Sensors placed in fields deliver real-time data about soil conditions, moisture levels, and crop growth. This information allows for informed decision-making that can save resources.

Moreover, artificial intelligence is making waves in agricultural practices. AI-driven models analyze vast amounts of data to predict yields accurately or optimize planting schedules.

Mobile apps also play a crucial role by connecting farmers with insights at their fingertips. From market trends to weather forecasts, these digital tools empower users to adapt swiftly.

Embracing innovation not only boosts efficiency but also paves the way for sustainable farming practices that benefit both producers and consumers alike.

Growth: Building Connections and Opportunities

AgTalk fosters growth by creating a vibrant community where farmers can connect. This platform allows users to share experiences, challenges, and solutions. Building relationships is key in agriculture.

Networking opens doors to new opportunities. Whether it’s collaborating on projects or sharing resources, the connections made through AgTalk are invaluable. Farmers can learn from each other’s successes and setbacks.

Moreover, AgTalk provides access to industry experts and mentors who offer guidance tailored to individual needs. These interactions cultivate trust and support among members.

As users engage with diverse perspectives, they discover innovative practices that enhance their operations. The collaborative environment encourages everyone to push boundaries together.

In this way, AgTalk not only strengthens existing ties but also lays the groundwork for future advancements in farming techniques and business strategies. Each connection has the potential to lead to transformative growth for individuals and communities alike.

Success Stories from AgTalk Users

AgTalk has become a powerful platform for farmers seeking support and insight. Many users have shared their success stories, illustrating the impact of this community.

One farmer in Iowa turned to AgTalk to solve pest problems affecting his corn yield. Through discussions with fellow members, he discovered innovative pest management strategies that significantly improved his harvest.

Another user from Texas found networking opportunities through AgTalk that led to collaborations on sustainable practices. These connections fostered new projects aimed at reducing water usage in their operations.

Diverse experiences showcase how sharing knowledge can transform farming practices. Users are not just exchanging tips; they’re building relationships that enhance their agricultural journeys. Each story highlights the power of connection and collaboration within the farming community, underscoring why platforms like AgTalk are essential for modern agriculture.

Future of AgTalk

The future of AgTalk is bright and full of potential. As technology advances, the platform will evolve to meet the changing needs of farmers.

New features are on the horizon that will enhance user experience and drive engagement. Imagine real-time data analytics tailored specifically for each farm’s unique conditions.

Collaboration tools may also see significant upgrades, allowing farmers to connect seamlessly with experts from various fields. This could mean more personalized advice and quicker responses when challenges arise.

As AgTalk grows, it aims to expand its global reach. Connecting farmers worldwide can foster an exchange of ideas and practices beneficial across different climates and regions.

With a focus on sustainability, we might witness a shift toward eco-friendly farming methods being shared widely within the community. Such innovations can help ensure food security while preserving our planet for future generations.

Conclusion

AgTalk serves as a vital platform for farmers looking to enhance their operations through connection, knowledge, and innovation. By bridging the gap between agricultural professionals, AgTalk fosters an environment where experienced voices share insights that can lead to better decision-making.

With its focus on the latest technologies and tools in farming, users are equipped with resources that drive efficiency and productivity. The community aspect of AgTalk is just as important; building relationships can open doors to new opportunities that may have otherwise gone unnoticed.

Success stories from users highlight how meaningful connections can translate into tangible results. As more farmers embrace this digital space, the potential for growth continues to expand.

The future of AgTalk looks promising as it evolves with user needs and technological advancements. It stands poised not only to revolutionize farming practices but also strengthen the agricultural community at large. Engaging with AgTalk means being part of something larger—an ongoing journey towards improved agriculture for everyone involved.

Business

Afruimwagens: Versatile Agricultural Wagons for Smart Farming

In the world of agriculture, efficiency and versatility are key to maximizing productivity. Farmers face numerous challenges daily, from managing crops to transporting goods. This is where agricultural wagons come into play, serving as indispensable tools that streamline operations and enhance overall performance on the farm. Among them, Afruimwagens stand out for their innovative designs and practical applications.

Whether you’re a seasoned farmer or just starting your agricultural journey, understanding how these versatile wagons can revolutionize your work is essential. With advancements in technology and design tailored specifically for farming needs, Afruimwagens offer solutions that make every task easier and more efficient. Let’s explore what makes these agricultural wagons such an asset in modern farming practices.

The Importance of Agricultural Wagons in Farming

Agricultural wagons play a pivotal role in the farming ecosystem. They facilitate the efficient movement of crops, equipment, and materials across vast fields. This mobility is crucial for maintaining productivity during peak seasons.

Farmers rely on these wagons to transport heavy loads without the risk of damage or spoilage. The right wagon can significantly reduce manual labor, allowing teams to focus on more critical tasks that contribute to crop health and yield.

Moreover, agricultural wagons enhance organization on farms. By streamlining logistics and enabling quick access to various areas of land, they support timely planting and harvesting operations.

In an era where time is money, investing in reliable agricultural transportation becomes essential for any farm looking to thrive in a competitive market. These versatile tools are not just vehicles; they represent efficiency at every turn.

Introduction to Afruimwagens and Their Benefits

Afruimwagens are redefining the landscape of modern agriculture. These versatile agricultural wagons cater to a wide array of farming needs, from transporting crops to moving equipment.

Farmers benefit significantly from their robust design and adaptability. Built for durability, Afruimwagens can handle varying terrains without compromising performance. This makes them an essential tool in diverse farming environments.

The flexibility offered by these wagons allows for efficient load management. With options for customization, farmers can tailor each wagon to suit specific tasks—whether hauling heavy loads or navigating tight spaces.

Moreover, Afruimwagens contribute to time savings on the farm. By streamlining transportation processes, they enable farmers to focus more on cultivation and less on logistics. Their innovative engineering reflects a commitment to enhancing productivity in smart farming practices.

Different Types of Afruimwagens Available

Afruimwagens come in various types designed to meet specific farming needs. Each variant offers unique features, enhancing versatility on the farm.

The standard Afruimwagen is perfect for transporting bulk materials. Its robust design ensures stability and durability even under heavy loads.

For specialized tasks, there are models equipped with hydraulic systems. These allow farmers to lift and unload cargo effortlessly, saving time and energy.

Then there are the multi-purpose wagons that can switch between different functions. Whether it’s hauling crops or livestock, these adaptable options make them a favorite among farmers looking for efficiency.

Some Afruimwagens focus on precision agriculture. They incorporate technology that helps monitor load weight and distribution, ensuring optimal performance during transport.

Innovative Features and Technology Used in Afruimwagens

Afruimwagens are designed with cutting-edge technology to meet the evolving needs of modern agriculture. One standout feature is their modular design, allowing farmers to customize the wagon based on specific tasks.

Equipped with GPS tracking, these wagons offer precise navigation and load management. This technology ensures that every trip is optimized for efficiency, reducing time and fuel costs significantly.

Another innovative aspect is the integration of smart sensors. These sensors monitor weight distribution and overall load capacity in real-time. This capability helps prevent overloading, enhancing safety during transport.

Additionally, some models come equipped with hydraulic systems for easy unloading and versatility in usage. Farmers can quickly switch from one type of cargo to another without hassle.

These features collectively elevate Afruimwagens as essential tools in smart farming practices today.

How Afruimwagens Improve Efficiency on the Farm

Afruimwagens significantly enhance efficiency on the farm by streamlining various agricultural processes. These versatile wagons can handle multiple tasks, from transporting tools to carrying harvested crops.

With their robust design and adaptability, Afruimwagens reduce the time spent on manual labor. Farmers can quickly load and unload materials, which saves valuable hours during peak seasons.

The wagons are often equipped with advanced features like hydraulic systems for easy lifting and dumping. This mechanization minimizes physical strain on workers while maximizing productivity.

Their ability to navigate different terrains further contributes to efficient operations. Whether it’s muddy fields or steep hills, Afruimwagens maintain stability and reliability.

By integrating these wagons into daily farming routines, producers experience smoother workflows. Efficient logistics lead to better resource management, allowing farmers focus more on growth strategies rather than logistical hassles.

Case Studies: Successful Implementation of Afruimwagens on Farms

One remarkable case study involves a maize farm in the Free State. The farmer integrated afruimwagens into his daily operations, significantly enhancing productivity. With these versatile wagons, he streamlined the transportation of crops from field to storage.

Another example comes from a fruit orchard in Limpopo. By utilizing afruimwagens, the owner improved harvest efficiency. The wagons made it easier for workers to collect and move fruits quickly without damaging delicate produce.

In both cases, farmers noted substantial time savings and reduced labor costs. They reported that their overall yield increased due to effective handling and transport of goods.

These real-life examples illustrate how adopting afruimwagens can transform agricultural practices and foster growth on diverse types of farms across South Africa’s dynamic landscape.

Advancements and Future Possibilities for Afruimwagens

The future of afruimwagens is bright, with ongoing advancements in technology. Manufacturers are increasingly integrating smart features into these agricultural wagons. Innovations like GPS tracking and automated loading systems enhance precision farming.

Sustainability is also a key focus. Many new models aim to reduce emissions and fuel consumption, aligning with eco-friendly practices in agriculture. This helps farmers not only save costs but also contribute positively to the environment.

Moreover, connectivity plays a significant role. With IoT integration, farmers can monitor their wagons remotely through mobile devices or computers. This data-driven approach allows for better decision-making on the farm.

The potential for customization remains vast as well. Farmers will soon be able to tailor afruimwagens to meet specific crop needs or terrain challenges effectively. As these developments unfold, the future of farming looks increasingly efficient and adaptable with afruimwagens leading the way.

Conclusion

Agricultural wagons play a pivotal role in modern farming. They enhance productivity, streamline logistics, and allow farmers to operate smarter in increasingly competitive markets. Afruimwagens stand out as a versatile solution tailored to meet the diverse needs of farmers today.

These innovative agricultural wagons are designed with efficiency and practicality at their core. By providing different types tailored for specific tasks, Afruimwagens cater to varied farming operations, ensuring that every farmer can find the right fit for their needs.

With cutting-edge technology integrated into their design, these wagons not only improve operational capabilities but also contribute to sustainable farming practices. Features such as advanced load management systems and durable materials help maximize performance while minimizing environmental impact.

The implementation of Afruimwagens has proven successful on numerous farms, showcasing significant improvements in both labor efficiency and crop transport processes. Real-world examples highlight how early adopters have reaped rewards by investing in this technology, paving the way for even greater advancements.

Looking ahead, the future possibilities for Afruimwagens appear promising. As agriculture continues evolving toward precision farming and data-driven decisions, these wagons will likely adapt further—potentially incorporating more automation features or integrating with smart farm technologies.

Afruimwagens exemplify what it means to embrace innovation within agriculture. Farmers equipped with these tools are better prepared to tackle challenges head-on while enhancing productivity across various aspects of their operations.

-

General3 weeks ago

General3 weeks agoQuikernews.com: Redefining Real-Time Journalism in the Digital Age

-

Entertainment4 weeks ago

Entertainment4 weeks agoPremiumIndo69: The Rise of an Exclusive Digital Ecosystem for Next-Gen Entertainment

-

Eo Pis1 month ago

Eo Pis1 month agoUnlocking the Power of EO PIs: A Personalized Path to Natural Wellness

-

Technology6 months ago

Technology6 months agoPi123: Revolutionizing Data-Driven Decisions with High-Speed, High-Accuracy Math Engines

-

Eo Pis1 month ago

Eo Pis1 month agoWhat is EO PIs? Unveiling the Healing Power Behind Essential Oils

-

General3 weeks ago

General3 weeks agoAvstarnews Contact Working Hours: Your Complete Guide to Reaching the Right Support at the Right Time

-

Technology3 weeks ago

Technology3 weeks agoهنتاوي.com: Redefining the Arabic Web Experience in a Digitally Localized World

-

Technology1 month ago

Technology1 month agoNewznav.com 8888996650: Unmasking the Mysterious Digital Duo Reshaping News and Communication in 2025